Charter Schools Help Drive Local Levies

Last week, several school districts had tax levies on the ballot. The Ohio Charter School Accountability Project looked at the levies being considered for new operating money[1] and found some fascinating correlations.

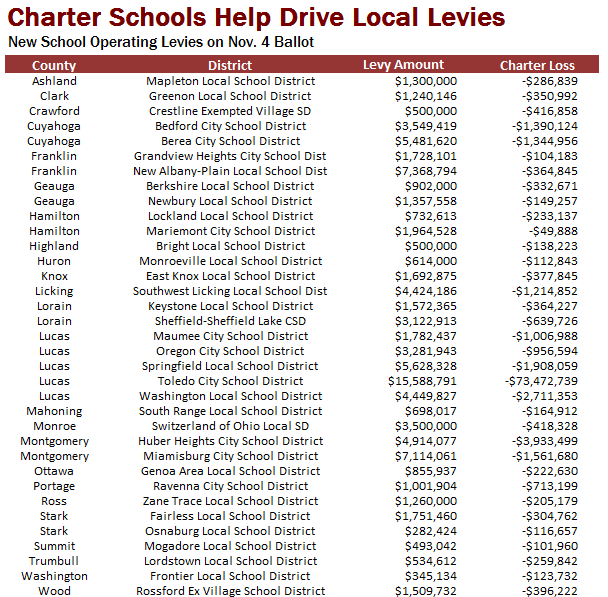

- The average amount of new money sought for school operations was $2,658,267. The average amount these districts lost to charter schools last school year was $2,755,709

- The total amount sought by these districts was $93 million. The total amount lost to charters in these districts was $96 million

These numbers were somewhat skewed by Toledo, which had a large levy on the ballot and loses $73 million to charter schools. Looking at the median figures, the median ask for new money was $1.5 million and the median loss to charters was $364,000.

However, the correlation between new money sought and money lost to charter schools is even stronger in some districts. For example, the Huber Heights’ levy sought $4.9 million. The district lost $3.8 million to charters. In Crawford County, Crestline sought $500,000 in their tax levy. They lose $417,000 to charter schools.

What these data clearly demonstrate is that the deductions in state aid to school districts that then go to charter schools have a real impact on both the need for and the amount of local tax levies being raised at the ballot box. The Ohio Supreme Court has ruled four times that relying too much on property taxes violates the state constitution. It appears that the funding of charter schools is forcing school districts to rely even more on revenue from local property taxes, in direct contravention of the Supreme Court ruling.

School Districts on November 2014 ballot seeking new local money for school operations, and the amount they lost to charter schools in the 2013-2014 school year

Of the 35 new money operating levies on the ballot last Tuesday, just 9 — or 25% — passed, at an additional cost to taxpayers of $38.8 million.

[1] We looked just at new money to fund operations because the operating budgets of local districts, and the money deducted for charter schools are directly impacted by decisions made by the state. New bond issues, permanent improvement, replacement or renewal levies were not included because those are not affected much, if at all by state operating budget decisions. Money for capital projects can’t be used to fill operating budget shortfalls, and vice versa.